Table of Contents

Divorce and Insurance Considerations: Introduction

A Guest Blog from Joe Finnerty of New York Life, discussing divorce and insurance considerations. Here’s Joe’s linkedIn page: https://www.linkedin.com/in/josephfinnertynyl/

1983 Marcus Ave Suite 210

Lake Success, NY 11042

(516) 458-5780

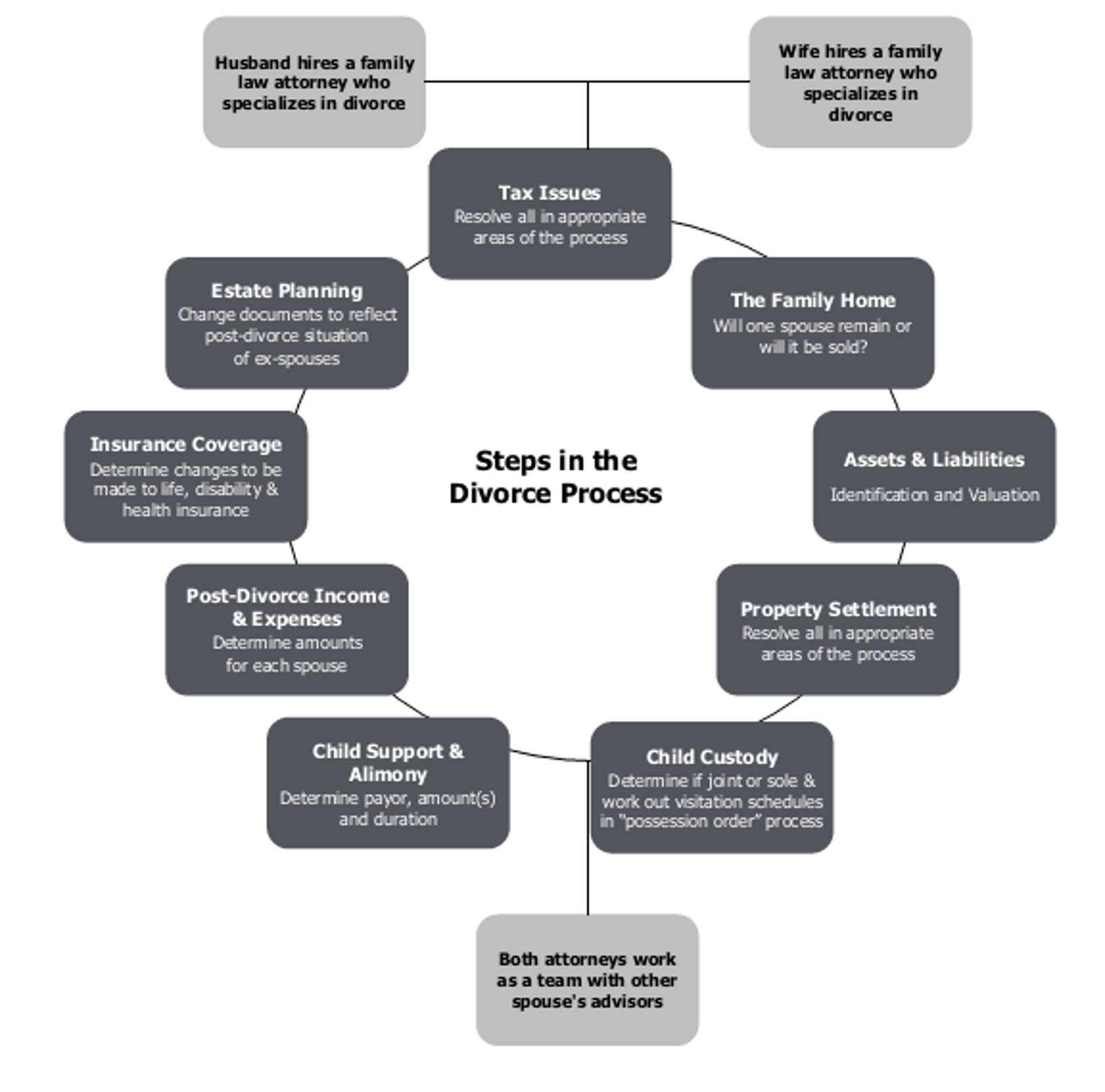

Joe discusses the importance of insurance in a divorce. The problem in a divorce is that while people can focus on the house, the pension, child custody, and support, there are other very important issues that also must be considered. Post-divorce insurance is one of them. Divorce and insurance are interrelated and mustn’t be ignored.

Overview of Divorce and Insurance Considerations

As with other major events in life, the divorce process may be one of the most emotionally difficult. Family concerns and sensitive emotional issues come to the forefront and are of primary importance to the parties involved, including the children. The financial issues often are pushed into the background. This is an unfortunate situation because divorce is one of the most common reasons for bankruptcy for one or both of the divorcing spouses. Divorce and insurance must be considered as part of the financial arrangements.

Division of Property

The division of property between the spouses can be one of the most difficult issues to resolve in the divorce process. The ultimate negotiated division of the assets will be documented in detail in the property settlement portion of the divorce decree.

The first step is to identify and value all of the assets. Some assets are easier to value than others, like bank accounts, brokerage accounts, stocks, bonds and mutual funds, since current account statements or current stock, bond, or mutual fund prices are readily obtainable. However, hiring a valuation expert may be necessary for assets that are difficult to value, such as a small business, investment real estate, artwork, or a defined benefit retirement plan.

If an asset is indivisible (e.g., a car, the house, etc.), one spouse may get the entire asset and the other spouse is “compensated” by getting other asset(s) of equal or similar value. The condition of an asset needs to be evaluated when determining value. For example, the house or a car may be in need of major repairs that need to be taken into account in the valuation process.

State divorce laws attempt to split the property both fairly and finally so the ex-spouses can, in theory, go on to live their separate lives and not have to be involved with continued joint ownership of property. Although divorce laws vary from state to state, each state’s divorce laws generally attempt to reach an “equitable” (but not necessarily equal) division of the property. Community property states have somewhat different laws, though commonly divide marital assets (i.e., assets acquired during the marriage) in half. Each spouse’s separate property (e.g., acquired before the marriage, inheritances, or gifts from third parties) is considered that spouse’s property for purposes of the divorce. However, “commingling” rules in a community property state may cause some or all of the separate property assets to be presumed to be community property. Due to the complexity and differences from state to state of the community property and “commingling” rules, details of these are beyond the scope of this article.

Child Custody

The issue of child custody may be one of the most emotional and contested parts of the divorce process. Most states require joint custody based upon the belief it is in the best interest of the children unless there is a compelling reason (e.g., child abuse, drug abuse by one parent) for granting sole custody to one parent over the other. Child custody and visitation schedules will be finalized in the form of a detailed “possession order” that is part of the divorce decree.

The amount of child support to be paid and which parent will be obligated to pay it is part of the divorce decree. The child support amount guidelines vary from state to state. Federal law mandates that child support payments be made by wage assignment. That way, the child support amount is automatically withheld from the wages of the parent responsible for payment. Many states have a program whereby the withheld child support amounts go into a special account, so it is recorded every month and ensures the children get the funds they need.

Post-Divorce Spousal Support (Maintenance)

Today, divorce settlements generally do not provide for spousal support in the form of maintenance. In New York in any divorce started after January 2016, maintenance is awarded on a mathematical calculation.

Retirement Income

If certain employer-sponsored retirement plans are to be divided between the spouses or transferred to the non-participant spouse, a “qualified domestic relations order” (QDRO) will be issued by the court. A QDRO clearly states the amount of the participant spouse’s benefits that the plan administrator must pay to an “alternate payee,” normally the former spouse and/or child. QDROs permit qualified retirement plan benefits to be used to fulfill property division, child support, and alimony obligations associated with the divorce.

- A QDRO is not needed for the division or transfer of individual retirement accounts between the spouses. These accounts are treated the same as other property under the divorce property division rules that allow for assets to be transferred without the recognition of gain or loss.

Defined benefit pension plans are more difficult to divide because such plans pay out a benefit at a future point in time. If such an asset is subject to the divorce property settlement, a present value calculation of the future benefit stream needs to be calculated. Then, a lump sum will be paid from other assets to the non-participant spouse for the value of the plan benefit to which it is agreed he or she is entitled. The alternative is for the non-participant spouse to receive the benefit payments directly when the participant spouse receives the plan benefit pay-out in the future. However, this is less common than the present value lump sum option previously discussed.

Divorce and Insurance Coverage

Both of the spouses’ life, disability, and health insurance need to be re-evaluated. Divorce and insurance, particularly life insurance necessarily involve a reevaluation. The divorce settlement will specifically address these current insurance policies and what the requirements will be for future coverage. There will be specific provisions in the divorce decree defining who is to maintain such coverage and pay premiums, for how long, and the beneficiaries. Remember to discuss divorce and insurance considerations with your lawyer.

If the divorce settlement requires a spouse to pay spousal support and/or child support, adequate life insurance should be carried on that spouse to secure payment of these court-ordered obligations in the event of the payor spouse’s death. Courts will generally require such insurance coverage. It also may be determined that proper disability insurance on the payor spouse be maintained to secure payment in the event of disability.

Health insurance coverage is another critical issue that needs to be addressed in the divorce settlement and will be detailed in the provisions of the divorce decree. No matter which parent they live with, the children’s health insurance coverage can be continued under either spouse’s coverage until they are adults. A “qualified medical child support order” (QMCSO) is a court order that requires health insurance for the children of the noncustodial parent under that parent’s group health plan. If the former spouse has no coverage at work, he or she may continue coverage through the ex-spouse’s health insurance plan for up to 36 months under the federal COBRA law. This would allow the former spouse time to obtain an individual health insurance policy.

Estate Planning

Both spouses should consider consulting an estate planning attorney during the divorce planning process to revise their respective estate planning documents to reflect their soon-to-be changed marital status.

Tax Implications

As part of the property division in the divorce, the transfer of property from one spouse to the other is tax-free (i.e., no gain or loss is recognized) if the transfer is “incident to a divorce.” This holds true even if the divorce decree is final and the parties are legally ex-spouses – as long as the transfer is “incident to the divorce,” the non-recognition rule will apply. The transfer of property must occur within one year from the date the marriage ceases, or the transfer must be related to the cessation of the marriage. Internal Revenue Code section 1041.

Where a QDRO has been used to meet the property division and/or alimony obligations of the retirement plan participant spouse, the alternate payee (i.e., the ex-spouse) is allowed to treat the payments the same as the plan participant spouse would treat them. The alternate payee will pay tax on the distribution as if it were his or her income. However, they are not subject to the 10% penalty even if they are less than age 591/2 if they roll over the distribution to an IRA.

Where a QDRO has been used to meet the child support obligations of the retirement plan participant spouse, the amounts paid to the alternate payee child are not taxed to the child but are taxed to the plan participant. Although these payments are not subject to the 10% penalty for early withdrawal, they cannot be rolled over to an IRA.

Child support is not tax deductible by the payer spouse and is not taxable to the recipient spouse. On the other hand, alimony is tax deductible by the payer spouse and is taxable to the recipient spouse.

Child custody may result in significant tax benefits for the custodial parent. The taxpayer must have custody of the child for a greater portion of the year to qualify as the “custodial parent.4” In addition, if the custodial parent taxpayer pays greater than half of the cost of maintaining the home, he/she can file his/her tax return as “head of household” (lower tax liability than “single” filing status), claim the exemption deduction for the child, and may be able to claim the dependent care credit.

The custodial parent is normally entitled to claim the exemption deduction for the child which also allows them to claim other tax credits related to the child. However, the custodial parent can allow the noncustodial parent to claim the exemption deduction for the child by executing IRS Form 8332 “Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.5”

Marital status as of the last day of the tax year determines the couple’s tax filing status for that tax year. If there is no final divorce decree or separate maintenance agreement obtained by the last day of the tax year, the couple must file as a married couple. In other words, they can file as either “married filing jointly” or “married filing separately.”

Where the divorcing couple is considered still married for tax filing purposes and they file a joint tax return, both husband and wife are jointly and severally liable for any taxes, interest, and penalties due on the joint tax return even if they should later divorce.6 This is the case even if the divorce decree should provide otherwise. It is possible to avoid this liability exposure by filing separately or by qualifying for “innocent spouse relief.” See IRS Form 8857, “Request for Innocent Spouse Relief,” and the accompanying instructions (Inst 8857) for more information.

IRS Publication 504, “Divorced or Separated Individuals,” and IRS Publication 555, “Community Property,” are other good sources of tax information on divorce issues.

The Social Security Administration’s booklet, “What Every Woman Should Know,” is a source of further information which, along with other information on divorce and Social Security benefits, can be found at the Social Security Administration’s web-site at www.socialsecurity.gov/.

About Joe:

I am an Agent licensed to sell insurance through New York Life Insurance Company and may be licensed with various other independent unaffiliated insurance companies. Additionally, I am a Registered Representative of and offer securities products & services through NYLIFE Securities LLC, (Member FINRA/SIPC), A Licensed Insurance Agency. Any testimonial on this site is based on an individual’s experience and may not be representative of the experience of other customers. These testimonials are no guarantee of future performance or success. Neither New York Life Insurance Company, nor its agents, provide tax, legal, or accounting advice. Please consult your own tax, legal, or accounting professionals before making any decisions. I am not licensed in all jurisdictions.

Disclaimers

This material includes a discussion of one or more tax-related topics prepared to assist in the promotion or marketing of the transactions or matters addressed. It is not intended (and cannot be used by any taxpayer) for the purpose of avoiding any IRS penalties that may be imposed upon the taxpayer. New York Life Insurance Company, its affiliates and subsidiaries, and agents and employees thereof, may not provide legal, tax or accounting advice. Individuals should consult with their own professional advisors before implementing any planning strategies.

© 2015 New York Life Insurance Company. All rights reserved. SMRU 1832889 (exp. 11.30.2021)